"JQJ213- Now With An Extra Cylinder!" (jqj213)

"JQJ213- Now With An Extra Cylinder!" (jqj213)

05/11/2015 at 09:41 • Filed to: None

1

1

21

21

"JQJ213- Now With An Extra Cylinder!" (jqj213)

"JQJ213- Now With An Extra Cylinder!" (jqj213)

05/11/2015 at 09:41 • Filed to: None |  1 1

|  21 21 |

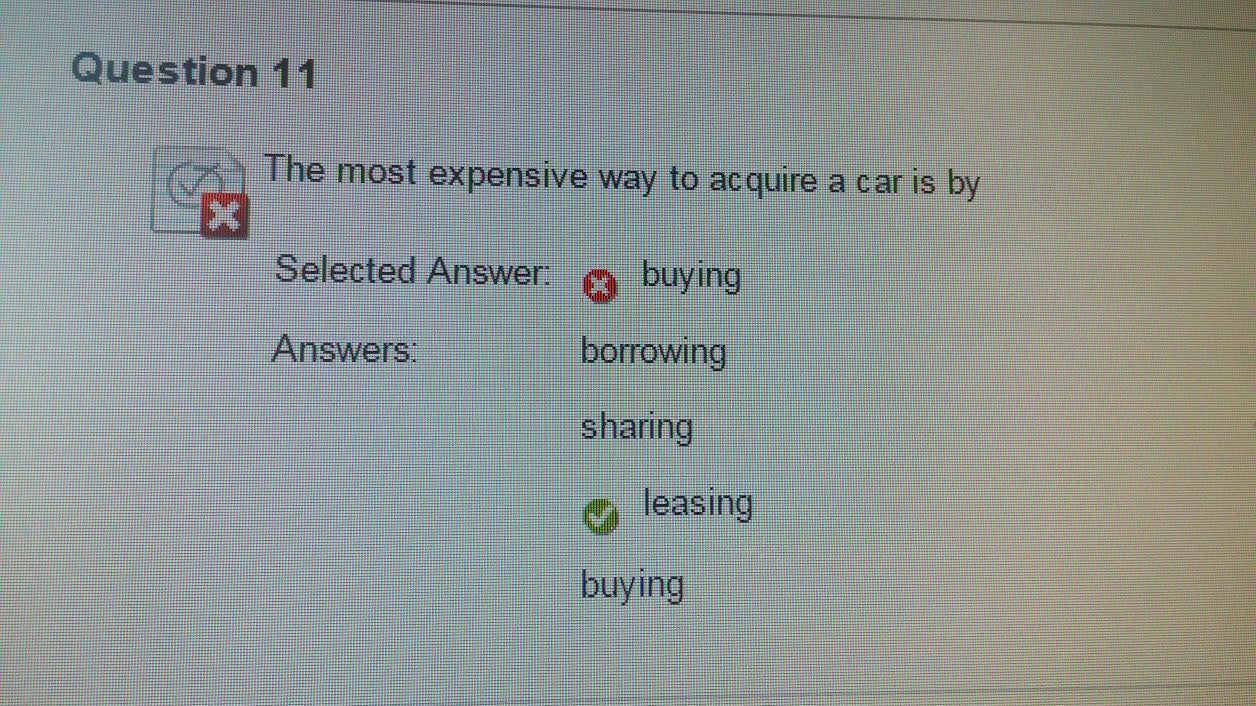

We have a test on vehicle ownership in my business class. This was the one question I got wrong and I disagree. A) the question is way too vague and doesn’t give any time frame or parameters. But, in theory, a lease always has cheaper payments since you only are paying for depreciation. Buying a car outright will typically have more monthly payments at a higher rate....

SidewaysOnDirt still misses Bowie

> JQJ213- Now With An Extra Cylinder!

SidewaysOnDirt still misses Bowie

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 09:45 |

|

Depends on what you mean by “acquire.” In my opinion, leasing is just renting.

Opposite Locksmith

> JQJ213- Now With An Extra Cylinder!

Opposite Locksmith

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 09:48 |

|

My dad would say leasing because at least at the end of the slightly high car payments in buying, you have an asset

Snuze: Needs another Swede

> JQJ213- Now With An Extra Cylinder!

Snuze: Needs another Swede

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 09:49 |

|

Answer F: Stealing

Definitely the cheapest way to acquire a car.

Sampsonite24-Earth's Least Likeliest Hero

> JQJ213- Now With An Extra Cylinder!

Sampsonite24-Earth's Least Likeliest Hero

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 09:49 |

|

someone hopped on the tavarish train

Rainbow

> JQJ213- Now With An Extra Cylinder!

Rainbow

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 09:50 |

|

You chose the only answer that would actually acquire a car, like the question states... I’d complain about this if it’s an important assignment.

Sir_Stig: and toxic masculinity ruins the party again.

> JQJ213- Now With An Extra Cylinder!

Sir_Stig: and toxic masculinity ruins the party again.

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 09:56 |

|

Leasing is almost always more expensive than buying, because you still don’t own the car after you are done the term.

JQJ213- Now With An Extra Cylinder!

> Rainbow

JQJ213- Now With An Extra Cylinder!

> Rainbow

05/11/2015 at 09:57 |

|

It’s a test so its worth a little bit

I’ll have to see what kind of grade I get with this one being wrong...

yamahog

> JQJ213- Now With An Extra Cylinder!

yamahog

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 09:58 |

|

If I were you and it was worth your time to do so, I’d talk to the teacher to understand the question’s definition of “acquire” better. If they’re assuming you’ll need to acquire a vehicle for the rest of your days, leasing will not be cheaper because you’ll either have to buy it out and eat that residual or start a new lease, and make payments forever... Whereas the higher monthly payment to finance a car (implied but not stated with ‘buying’) would leave you with a car and no more payments at the end of those 48-60 months.

Showing an understanding of the concepts but having a semantic misunderstanding will probably be enough for partial credit if you need it.

JQJ213- Now With An Extra Cylinder!

> SidewaysOnDirt still misses Bowie

JQJ213- Now With An Extra Cylinder!

> SidewaysOnDirt still misses Bowie

05/11/2015 at 09:58 |

|

Exactly... you really aren’t getting a car out of leasing

JQJ213- Now With An Extra Cylinder!

> Opposite Locksmith

JQJ213- Now With An Extra Cylinder!

> Opposite Locksmith

05/11/2015 at 09:59 |

|

But my question is the fact that leasing doesn’t have you really acquiring anything

Sir Classy III

> JQJ213- Now With An Extra Cylinder!

Sir Classy III

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 10:00 |

|

Well it also depends on how many miles are put on it in the time you own it. The lease assumes a certain amount of miles are going to be on it when they get it back. If it is under that and you buy it out post-lease and then sell it for more than you bought it out for.

Dr. Zoidberg - RIP Oppo

> Rainbow

Dr. Zoidberg - RIP Oppo

> Rainbow

05/11/2015 at 10:00 |

|

I think acquisition merely implies possession, not necessarily ownership. Semantics, I’m sure.

GhostZ

> JQJ213- Now With An Extra Cylinder!

GhostZ

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 10:02 |

|

It depends ENTIRELY on residual value. Leasing a car is a bet against its resale value, that it will resale lower than the residual value, meaning that the bank issuing the lease eats the depreciation instead of you.

Buy the car if you think it’s resale is going to be HIGHER than the residual value that the lease is calculated on.

This question assumes that bank-calculated residual values are going to always reflect resale value, which would mean that lease payments would exceed interest on an auto loan. But that isn’t always true, especially when you take into effect what recalls, newer models/trims, or changes in gas prices affect resale value of certain cars.

Smack your business teacher across the face. No reason you should have missed that question. It was very poorly written.

Flat Six

> JQJ213- Now With An Extra Cylinder!

Flat Six

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 10:10 |

|

Leasing is typically the most expensive for a long term purchase (say 10 years). However there isn’t enough information here to answer the question definitively. Sometimes you can get a very good rate and favorable residual which makes leasing less expensive over a known time period. When you lease the seller takes all of the risk of depreciation; when you buy the buyer takes all the risk.

ArmadaExpress drives a turbo outback

> JQJ213- Now With An Extra Cylinder!

ArmadaExpress drives a turbo outback

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 10:11 |

|

I think Leasing is the correct answer. Because I lease deal often time also gives you the option to purchase the car afterwards, and you’re paying way over the value of the car at that point.

CAR_IS_MI

> JQJ213- Now With An Extra Cylinder!

CAR_IS_MI

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 10:15 |

|

Trick question???

Buying you will acquire the car, but buying does not mean financing, because you can buy a car straight cash and then you have paid exactly what it’s worth at that moment.

Borrowing you pay nothing or next to nothing to use the car with the intent of returning it to its actual owner, so you never acquire the car.

Sharing means you already have acquired the car and are letting other people use it. Whether or not they are paying you for that is a different story.

And finally leasing, you pay money for an extended period of time but at the end of the contract you give the car back to its owner, so again, you never truly acquire the car.

Dr. Zoidberg - RIP Oppo

> Opposite Locksmith

Dr. Zoidberg - RIP Oppo

> Opposite Locksmith

05/11/2015 at 10:18 |

|

I would say it depends on what you buy. If you buy a Taco or WRX, they hold their resale very well. If you bought a new S-class, you’re taking a massive loss years later if you choose to sell or trade in.

Opposite Locksmith

> Dr. Zoidberg - RIP Oppo

Opposite Locksmith

> Dr. Zoidberg - RIP Oppo

05/11/2015 at 10:23 |

|

Good thing I bought a WRX :)

nermal

> JQJ213- Now With An Extra Cylinder!

nermal

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 10:37 |

|

The answer is that it depends.

With leasing you only pay for depreciation. Theoretically, you should be able to buy a car and sell in 3 yrs for about the same as what the residual value the leasing company sets. So, they should run about the same. Realistically, there may be a difference between the residual value set by the leasing company and what you can actually sell a 3 yr old car for.

The biggest thing that gets ignored in all of these conversations: A NEW CAR WILL DEPRECIATE, REGARDLESS OF HOW YOU FINANCE IT. Your car will still be worth significantly less when it is 3 yrs old.

TxBrumski

> JQJ213- Now With An Extra Cylinder!

TxBrumski

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 12:06 |

|

That’s way too simplistic of a question. Also, why is “buying” on there twice?

If only EssExTee could be so grossly incandescent

> JQJ213- Now With An Extra Cylinder!

If only EssExTee could be so grossly incandescent

> JQJ213- Now With An Extra Cylinder!

05/11/2015 at 16:17 |

|

At the end of a lease you give the car back so technically it’s not even “acquiring a car” in the first place.